Life insurance is a crucial financial instrument that provides security and peace of mind for individuals and their families. This article delves into the unique scenario of when twin brothers applied for life insurance or twin brothers applying for life insurance, exploring the intricacies, considerations, and experiences they encounter during the application process.

Twin brother Insurance

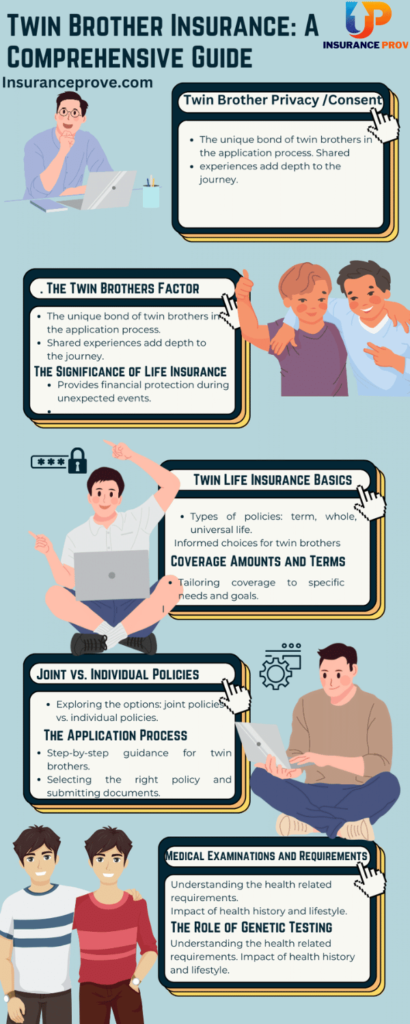

The Significance of Life Insurance

Life insurance is more than just a financial product; it safeguards your loved ones’ future. It offers financial protection in unexpected events and ensures your family can maintain their quality of life.

The Twin Factor

Twin brothers embarking on the journey of life insurance bring a distinct perspective. Their unique bond and shared experiences add depth to the application process.

Life Insurance Basics

Types of Life Insurance Policies

Understanding the various life insurance policies, such as term life, whole life, and universal life, helps twin brothers make informed choices.

Coverage Amounts and Terms

I am exploring the differences in coverage amounts and policy terms, considering the specific needs and goals of twin brothers.

Twin Brothers’ Decision to Apply

Motivations and Considerations

They are delving into the motivations driving twin brothers to seek life insurance, including protecting their families, securing debts, or planning for the future.

Joint vs. Individual Policies

They discussed the options of joint life insurance policies, which cover both brothers, versus individual policies, allowing each to tailor their coverage independently.

The Application Process

Completing the Application

A step-by-step guide on how twin brothers navigate the life insurance application process, from selecting the right policy to submitting the required documents.

Medical Examinations and Requirements

It was understanding the medical examinations and health-related requirements necessary for the application, including factors like health history and lifestyle.

Underwriting and Risk Assessment

How Twins’ Genetics Affect Underwriting

We are exploring how the genetic similarities between twin brothers can influence underwriting decisions, potentially affecting premium rates.

Assessing Risk and Premiums

They are determining the risk factors and premium rates associated with when twin brothers applied for life insurance, considering their health, lifestyle, and other variables.

Insurance Policy Customization

Beneficiary Designations

Discussing the process of choosing beneficiaries and the roles they play in the life insurance policy, particularly when twin brothers are involved.

Riders and Additional Coverage

We are exploring the options for adding riders and supplementary coverage to tailor the policy to the unique needs and preferences of twin brothers.

The Role of Genetic Testing

Genetic Testing and Life Insurance

We are analyzing the impact of genetic testing on life insurance applications for twin brothers, considering both the benefits and potential drawbacks.

Privacy and Consent

We are addressing privacy concerns and the importance of informed consent when undergoing genetic testing during the life insurance application process.

Twin Brothers’ Case Studies

Real-Life Experiences

Sharing case studies of real-life twin brothers and their life insurance journeys, providing insight into the challenges and successes they encountered.

Outcomes and Considerations

They discussed the outcomes of the case studies and the considerations that should guide other twin brothers in their life insurance applications.

Premium Payments and Billing

Premium Payment Options

Exploring the various payment methods available for twin brothers, including monthly, annual, and other payment plans.

Billing and Policy Management

They are addressing the details of billing and policy management, ensuring that twin brothers can effectively manage their life insurance coverage.

Annual Check-ins and Policy Reviews

Importance of Regular Reviews

It highlights the significance of conducting regular policy reviews to ensure that the coverage remains aligned with the evolving needs and circumstances of twin brothers.

Adapting to Life Changes

We advise adapting the life insurance policy to significant life changes, such as marriage, parenthood, or changes in financial status.

Legal and Ethical Considerations

Legal Implications and Documentation

Addressing the legal aspects and required documentation involved in the life insurance application process for twin brothers.

Ethical Concerns in Life Insurance

We discussed the ethical considerations that arise during the application, ensuring that the process is conducted with fairness and transparency regarding the query “when twin brothers applied for life insurance.”

Family and Beneficiary Communication

Talking to Family Members

We provide guidelines for twin brothers on discussing their life insurance decisions with family members, considering the potential impact on beneficiaries.

Beneficiary Awareness

He stressed the importance of beneficiaries understanding the policy details and navigating the life insurance process when needed.

Investment and Cash-Value Policies

Investment Aspects

They are exploring investment-linked life insurance policies, which allow twin brothers to accumulate cash value over time, providing both protection and a financial asset.

Cash-Value Policies

They understand the benefits of cash-value life insurance policies, which offer a combination of protection and savings that can be accessed during their lifetime.

Tax Implications

Tax Benefits

They are detailing the potential tax benefits and implications for twin brothers related to their life insurance policies.

Tax Planning Strategies

I am exploring tax planning strategies to optimize the financial advantages when twin brothers apply for life insurance.

Twin Brothers’ Financial Planning

Integrating Life Insurance into Financial Planning

Advising how to integrate life insurance into their overall financial planning, ensuring it aligns with their broader financial goals.

Financial Advisors’ Role

They were discussing the role of financial advisors in assisting twin brothers with their life insurance and broader financial planning.

Pros and Cons

Here are the pros and cons related to the process of when twin brothers applied for life insurance:

Pros:

- Cost-Efficiency: Joint life insurance policies can be cost-effective for twin brothers, potentially leading to lower premiums.

- Shared Benefits: Both twins benefit from the same policy, providing a financial safety net for each other.

- Simplified Management: Managing one joint policy can be more straightforward than two individual policies, simplifying administrative tasks.

- Potential Savings: Some policies allow cash value accumulation, offering a financial asset and protection.

- Tax Benefits: Depending on the policy and financial situation, there may be tax advantages to explore.

Cons:

- Limited Independence: Joint policies may limit individual decision-making, which could be a drawback if the twins have different financial goals.

- Health Changes: If one twin’s health deteriorates after obtaining a policy, it may not impact the other twin’s coverage, potentially leading to disparities.

- Complex Decisions: Deciding between joint and individual policies can be difficult and requires careful consideration.

- Privacy Concerns: Undergoing genetic testing can raise privacy concerns, which twin brothers need to address.

- Tax Implications: While there may be tax benefits, navigating the tax implications can be intricate and require professional advice.

This comprehensive guide offers twin brothers valuable insights into the world of life insurance applications, helping them make informed decisions tailored to their unique circumstances and goals. Whether choosing joint or individual policies, considering genetic testing, or managing changing life circumstances, this guide provides a human touch to a crucial financial decision.

Conclusion

The journey of twin brothers applying for life insurance is unique and complex. This comprehensive guide has explored the various facets of this process, from understanding the significance of life insurance to navigating the intricacies of underwriting, policy customization, and even the role of genetic testing. It has provided insights into how genetics can affect underwriting decisions and how regular policy reviews and adaptations to life changes are essential.

Legal and ethical considerations have been addressed, emphasizing the importance of transparent and fair practices. Communication with family and beneficiaries has been stressed, ensuring the process is understood and the benefits can be effectively realized.

The guide also discussed investment and cash-value policies, tax implications, and the integration of life insurance into broader financial planning. Financial advisors are crucial in assisting twin brothers in making well-informed decisions.

Frequently Asked Questions (FAQs)

Here are the Frequently Asked Questions related to the process of when twin brothers applied for life insurance:

Are there specific advantages for twin brothers applying for life insurance together?

Twin brothers have the opportunity to explore joint life insurance policies, which can be a cost-effective option. These policies cover both individuals under one plan, potentially leading to lower premiums.

What types of life insurance are suitable for twin brothers?

Twin brothers can consider various types of life insurance, including term life, whole life, or universal life. The choice depends on their specific needs and financial goals.

How does genetic testing impact life insurance applications for twins?

Genetic testing can influence underwriting decisions and premium rates. Twin brothers must discuss the implications with their insurance provider before undergoing genetic testing.

Is it advisable to have a joint life insurance policy, or should each twin have an individual policy?

The decision between joint and individual policies depends on the twins’ unique circumstances and financial goals. Respective policies offer independence, while standard procedures may be more cost-effective.

What happens if one twin brother faces changes in health after obtaining a life insurance policy?

If one twin experiences health changes, it doesn’t typically affect the other’s coverage in a joint policy. However, individual policies may be impacted differently.

How can twin brothers adapt their life insurance to changing life circumstances, such as marriage or parenthood?

Twin Brothers should conduct regular policy reviews and communicate with their insurance provider to ensure their coverage aligns with evolving life circumstances.

Are there any tax benefits associated with life insurance for twin brothers?

Depending on the type of policy and the twins’ specific financial situation, there may be tax benefits. Consulting a tax advisor is advisable to maximize these benefits.