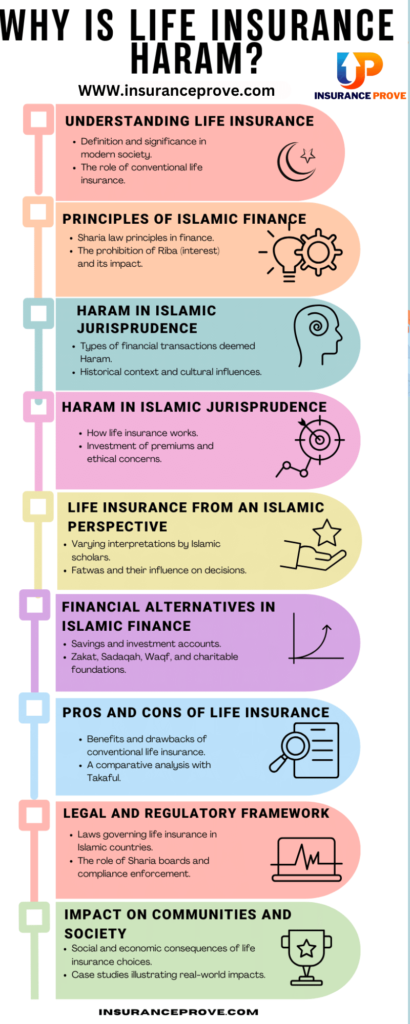

Life insurance has become an integral part of modern society, providing individuals with financial security and peace of mind in uncertain circumstances. However, for some, especially in Islamic communities, life insurance raises a significant ethical dilemma. This article explores the intricacies of the question, “Why is life insurance haram?” We delve into the principles of Islamic finance, the concept of haram in Islamic jurisprudence, and the mechanics of life insurance. We’ll also examine life insurance from an Islamic perspective, its connection to riba (interest), and alternative models like Takaful.

Life Insurance in Islam

Definition of Life Insurance

Life insurance is a financial contract between an individual and an insurance company. In exchange for regular premium payments, the insurer agrees to provide a lump sum or periodic payments to the policyholder’s beneficiaries upon death.

Significance in Modern Society

Life insurance has gained significance in modern society by offering financial protection to families, businesses, and individuals. It ensures that dependents are financially secure in the event of the policyholder’s demise, covering various expenses like funeral costs, debts, and future financial needs.

The Basics of Islamic Finance

Principles of Islamic Finance

Islamic finance is grounded in Sharia law and is governed by principles that include risk-sharing, asset backing, and the prohibition of riba (interest). Why is Life Insurance Haram? These principles aim to create a just and ethical financial system.

Prohibition of Riba (Interest)

Riba, or usury, is strictly prohibited in Islam. Any financial transaction involving interest is considered haram, as it is believed to exploit individuals and lead to economic inequality.

Significance of Halal and Haram

Halal refers to what is permissible in Islamic law, while haram refers to what is forbidden. Understanding the boundaries between these two is crucial in Islamic finance.

Why is Life Insurance Haram?

Understanding the Concept of Haram

- Haram in Islamic Jurisprudence

Islamic jurisprudence outlines what is considered haram in various financial transactions. Understanding these rulings is essential in assessing the permissibility of life insurance.

- Types of Financial Transactions Deemed Haram

Certain types of financial transactions, such as gambling, speculative investments, and interest-based contracts, are deemed haram in Islamic finance.

- Historical Context of Prohibitions

The historical context of these prohibitions sheds light on their origins and the challenges they aim to address in Islamic society.

Life Insurance and its Mechanics

How Life Insurance Works

Life insurance operates on the principles of risk pooling and the law of large numbers. Policyholders pay premiums into a common fund, which is used to pay out death benefits.

The Role of Insurance Companies

Insurance companies play a pivotal role in managing the risk and funds, ensuring the financial stability of the system.

Investment of Premiums

Life insurance premiums are typically invested in various assets to generate returns, raising concerns about how these investments align with Islamic finance principles.

Life Insurance from an Islamic Perspective

Overview of Islamic Views on Life Insurance

Islamic scholars have varying perspectives on life insurance. Some view it as a form of cooperative risk-sharing, while others deem it haram due to its connection to interest.

Interpretations of Islamic Scholars

Different scholars provide diverse interpretations of Islamic teachings, making it essential to understand the range of opinions.

Fatwas and Rulings

Fatwas, or religious rulings, are issued by scholars and Islamic councils. These fatwas can influence individual and community decisions regarding life insurance.

Life Insurance from an Islamic Perspective

The Riba Connection

- The Presence of Interest in Conventional Insurance

Conventional life insurance often involves interest-bearing investments, which conflict with the prohibition of riba in Islamic finance.

- Implications for Islamic Ethics

The presence of interest in life insurance raises ethical concerns in the context of Islamic finance and societal values.

- Is It All About Interest?

Examining whether the issues surrounding life insurance are solely about interest or encompass broader ethical considerations is essential.

Mutual Insurance Models

Takaful: The Sharia-Compliant Alternative

Takaful is a Sharia-compliant insurance model that emphasizes cooperation and mutual assistance.

How Takaful Differs from Conventional Insurance

Takaful differs from conventional insurance’s structural and operational aspects, aligning more closely with Islamic principles.

The Growing Popularity of Takaful

The popularity of Takaful has been steadily increasing as it offers an alternative considered halal by Islamic scholars.

The Controversies Surrounding Takaful

Challenges in Takaful Implementation

Takaful faces challenges in its implementation, including regulatory, operational, and awareness-related hurdles.

Critiques and Concerns

Critiques and concerns about Takaful’s effectiveness and adherence to Islamic principles have arisen.

Efforts for Improvement

Efforts are being made to address these critiques and improve the Takaful model to make it more accessible and practical.

Historical Context and Cultural Influences

How Historical Events Shaped Views on Life Insurance

The historical context of specific regions and periods has influenced the acceptance or rejection of life insurance.

Cultural Beliefs Impacting Perspectives

Cultural beliefs and traditions play a significant role in shaping people’s perspectives on life insurance.

Evolution of Opinions Over Time

Opinions on life insurance have evolved as societies have changed and adapted to new financial instruments.

Financial Alternatives in Islamic Finance

Savings and Investment Accounts

Savings and investment accounts are popular financial alternatives in Islamic finance that offer halal investment opportunities.

Zakat and Sadaqah

Zakat and Sadaqah are forms of charitable giving in Islam, providing financial support to those in need.

Waqf and Charitable Foundations

Waqf and charitable foundations serve as long-term financial solutions aligned with Islamic ethics.

Financial Alternatives in Islamic Finance

Real-Life Examples of Life Insurance and Takaful Use

Exploring real-life cases can provide insights into how individuals and communities have navigated the ethical dilemma of life insurance.

Outcomes and Impacts

Understanding the outcomes and impacts of life insurance and Takaful can help evaluate their effectiveness and consequences.

Lessons Learned

There are valuable lessons to be learned from the experiences of those who have grappled with the haram question in life insurance.

Ethical Dilemmas and Personal Choices

Balancing Financial Security and Religious Beliefs

Individuals face a challenging dilemma when they must balance the need for financial security with their religious convictions.

Stories of Individuals’ Decision-Making

Personal stories and accounts of individuals who have made these decisions provide a human perspective on this ethical dilemma.

Moral Implications

The moral implications of life insurance choices can weigh heavily on individuals, their families, and their communities.

Pros and Cons of Life Insurance

Benefits of Conventional Life Insurance

Conventional life insurance offers various benefits, such as financial protection, peace of mind, and estate planning advantages.

Drawbacks of Conventional Life Insurance

Drawbacks of conventional life insurance include the potential for high premiums and concerns about the ethical aspects.

A Comparative Analysis

Comparing the pros and cons helps individuals make informed decisions regarding life insurance.

Pros and Cons of Takaful

Benefits of Takaful

Takaful provides a halal alternative with benefits like risk-sharing, community support, and ethical investment.

Drawbacks of Takaful

Takaful also has limitations and drawbacks that individuals should consider when evaluating its suitability.

A Comparative Analysis

Comparing Takaful with conventional life insurance highlights the key differences and considerations for consumers.

Legal and Regulatory Framework

Laws Governing Life Insurance in Islamic Countries

Understanding the legal and regulatory framework governing life insurance in Islamic countries is vital for compliance.

The Role of Sharia Boards

Sharia boards play a critical role in assessing the compliance of financial institutions and products with Islamic principles.

Compliance and Enforcement

Ensuring compliance with Islamic finance principles involves mechanisms for enforcement and accountability.

Contemporary Debates and Resolutions

Evolving Views on Life Insurance

The perspectives on life insurance within Islamic communities are evolving, with new debates and discussions emerging.

Innovative Solutions and Proposals

Innovative solutions and proposals are being developed to address the ethical dilemmas surrounding life insurance.

Bridging the Gap

Efforts to bridge the gap between the financial needs of individuals and the ethical requirements of Islamic finance are ongoing.

Impact on Communities and Society

How Life Insurance (or Lack of It) Affects Communities

The presence or absence of life insurance can significantly impact communities, both financially and socially.

Social and Economic Consequences

Understanding the social and economic consequences of life insurance choices is crucial in assessing its broader impact.

Case Studies on Impact

Case studies provide real-world examples of how life insurance decisions influence communities and society.

Summary and Conclusions

Summarizing the key points of this article provides readers with a concise understanding of the ethical dilemma surrounding life insurance.

The Complexity of the Issue

The complexity of this issue underscores the need for careful consideration and informed decision-making.

Call for Informed Decision-Making

This article calls for readers to make informed decisions regarding life insurance, considering their beliefs and values.

References and Further Reading

Citing Sources

Citing sources ensures the accuracy and credibility of the information presented in this article.

https://islamqa.info/en/answers/102969/ruling-on-car-insurance

Online Resources

Online resources offer a convenient way for readers to access more information and diverse perspectives on this complex issue.

This comprehensive article explores the ethical dilemma of Why is Life Insurance Haram, providing in-depth information and insights to guide readers in making informed decisions.

Frequently Asked Questions:

Here are the queries related to the “Why is Life Insurance Haram?”

What is the meaning of “Haram” in the context of life insurance?

“Haram” refers to something forbidden or prohibited in Islamic law. In the context of life insurance, it signifies that some aspects of conventional life insurance may be considered ethically and religiously impermissible in Islam due to the involvement of interest (riba) and other elements conflicting with Islamic principles.

Why is life insurance considered haram in Islam?

Life insurance is considered haram in Islam due to its association with riba (interest) and speculative elements. Islamic finance principles prohibit involvement in activities that involve interest, gambling, or uncertainty, and some conventional life insurance products may include these elements.

What is Takaful, and how does it differ from conventional life insurance?

Takaful is a Sharia-compliant insurance model that differs from conventional life insurance in several ways. Takaful is based on the principles of cooperation and risk-sharing, eliminating interest-based transactions and adhering to Islamic finance principles. In contrast, conventional insurance relies on interest-bearing investments and profit-making, incompatible with Islamic ethics.

Are there any scholars or Islamic authorities who permit life insurance in certain circumstances?

Yes, there are varying opinions among Islamic scholars and authorities regarding the permissibility of life insurance. Some scholars consider life insurance acceptable if structured in a Sharia-compliant manner. Fatwas (religious rulings) from different scholars and Islamic councils may also guide specific circumstances where life insurance is allowed.

Can Muslims have any form of insurance for financial protection?

Muslims have several alternatives to conventional life insurance, including Takaful, savings and investment accounts that comply with Islamic finance principles, and charitable options like Zakat, Sadaqah, and Waqf. These alternatives provide financial security while remaining consistent with Islamic ethics.

How can I determine if a life insurance product is Sharia-compliant?

To determine if a life insurance product is Sharia-compliant, it is essential to consult with Islamic scholars or experts in Islamic finance. They can evaluate the terms and conditions of the insurance policy to ensure that it adheres to Islamic principles and does not involve interest, gambling, or unethical elements.

What are the alternatives to conventional life insurance for Muslims?

Muslims have several alternatives to conventional life insurance, including Takaful, savings and investment accounts that comply with Islamic finance principles, and charitable options like Zakat, Sadaqah, and Waqf. These alternatives provide financial security while remaining consistent with Islamic ethics.

Are there any legal requirements regarding life insurance in Islamic countries?

The legal requirements for life insurance in Islamic countries vary. Some Islamic countries have developed specific regulations and frameworks for Takaful, while others may allow conventional life insurance under certain conditions. It’s essential to understand the legal and regulatory framework in your specific region or country.

How do cultural beliefs impact the perception of life insurance in Islamic communities?

Cultural beliefs can significantly impact how individuals within Islamic communities perceive life insurance. Some cultural norms and traditions may influence people’s willingness to participate in life insurance, regardless of its religious permissibility. Understanding these cultural influences is crucial in addressing the topic.

What should individuals consider when making decisions about life insurance in Islamic contexts?

When making decisions about life insurance in Islamic contexts, individuals should consider their religious beliefs, financial needs, and the ethical aspects of insurance products. Consulting with knowledgeable scholars or experts in Islamic finance can provide valuable guidance in navigating this complex issue.