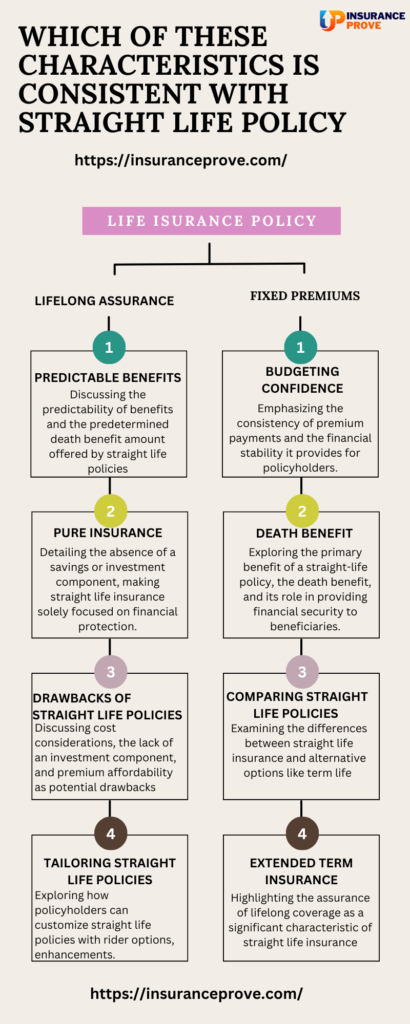

The consistent characteristics of a Straight Life Policy include lifelong coverage, unchanging premium payments, and a focus solely on providing financial protection. This policy offers stability, predictability, and a clear purpose, making it an ideal choice for those seeking long-term financial security.

Consistent Characterstics of Straight Life Policy

Premiums must be paid as long as there is active insurance coverage. A characteristic consistent with a straight-life policy is that it provides coverage for the entire insured’s entire lifetime without an expiration date. It has no cash value component or investment features like other life insurance policies.

Significance of Life Insurance

In today’s uncertain world, life insurance is pivotal in providing financial security and peace of mind to individuals and their loved ones. It offers a safety net that ensures that in the event of an unforeseen tragedy, your family can maintain their quality of life. One necessary type of life insurance policy is the straight life policy. But which of these characteristics is consistent with straight life policy? In this comprehensive guide, we will delve into the various facets of straight life insurance, shedding light on its unique features and advantages.

The Allure of Straight Life Policies

Straight-life policies have a special allure for those seeking a stable and lifelong insurance solution. They offer consistent coverage and financial security for the entirety of your life. But before we explore their characteristics, let’s understand the basics of straight life insurance.

Exploring the Basics Straight Life Policy

What Is a Straight Life Policy?

A straight life policy, or whole life insurance, is permanent life insurance that covers your entire lifetime. It is a straightforward and no-frills insurance product, which can be an ideal choice for those who value predictability and long-term financial planning.

Straight Life Policy Key Components

Understanding the critical components of a straight-life policy is crucial. These components include a guaranteed death benefit, fixed premiums, and the absence of a cash value component. To determine which of these characteristics is consistent with a straight life policy, we need to explore each in detail.

Lifelong Insurance Coverage

Lifetime Assurance characteristic

A significant characteristic of straight life insurance is the assurance of lifelong coverage. With a straightforward life policy, you don’t have to worry about your coverage expiring after a certain period. The policy remains in force throughout your lifetime, providing peace of mind to you and your beneficiaries.

Life Insurance No Expiry Date

Unlike some other types of life insurance, straight life policies have no expiry date. This means that as long as you continue to pay your premiums, your coverage remains intact. This characteristic ensures that your loved ones will receive the death benefit when you pass away, regardless of when that may occur.

Lifelong Policy Duration

Lifelong Commitment

Straight-life policies require a lifelong commitment. When you purchase such a policy, you are committing to maintain it for the entirety of your life. This commitment is a strong reflection of the policy’s consistency.

Stability Over Time

The stability that straight-life policies offer over time is a characteristic many individuals find appealing. These policies provide financial security by locking in your premium rates, ensuring they remain consistent over the years.

Which of these characteristics is consistent with a straight life policy

Predictable Benefits

One of the characteristics consistent with a straight-life policy is the predictability of benefits. You and your beneficiaries can rely on a predetermined death benefit amount, which will be paid out when you pass away. This predictability simplifies financial planning and provides peace of mind.

No Surprises

With a straight life policy, there are no surprises. Unlike some investment-linked policies, straightforward life insurance is not subject to market fluctuations. It offers a stable and reliable source of protection.

Straight Life Insurance Premium Structure

Fixed Premiums

Fixed premiums are a hallmark of straight life insurance. These premiums remain constant throughout the life of the policy. This feature provides policyholders with budgeting confidence, as they know exactly how much they need to pay each year.

Budgeting Confidence

Knowing your premium costs will remain the same allows for effective long-term budgeting. This financial stability is another characteristic consistent with a straight life policy.

Fixed Premiums

Unchanging Costs

Straight-life policies offer unchanging premium costs. This permanent nature of premiums ensures long-term affordability for policyholders.

Long-Term Affordability

Long-term affordability is a crucial consideration for individuals seeking to secure their family’s financial future. The consistency of premium payments is a significant benefit of straight life insurance.

Predictable Cost

Budgeting Benefits

Budgeting benefits are evident when considering the predictable cost of straight life insurance. With fixed premiums, you can effectively plan your finances over the years, which is a valuable characteristic for those looking for financial stability.

Financial Stability

Financial stability is a primary concern for many families. The predictable cost structure of straight-life policies contributes to this stability, making it easier for policyholders to manage their financial resources.

No Cash Value Component

Pure Insurance

Straight-life policies focus on providing pure insurance coverage. This means that the primary purpose of these policies is to offer financial protection to your beneficiaries in the event of your death.

Focus on Protection

The absence of a cash value component emphasizes the policy’s focus on protection. While other types of life insurance may incorporate an investment or savings element, straight life insurance maintains a clear and singular purpose.

Purely Insurance

No Savings Element

One of the characteristics consistent with a straight life policy is the absence of a savings or investment component. This distinguishes it from other life insurance products that combine insurance with wealth accumulation features.

Purpose-Driven

Straight life insurance is purpose-driven. It serves the primary purpose of providing financial security to your beneficiaries, with no secondary investment or savings goals.

Absence of Savings

No Cash Accumulation

With straight life insurance, there is no cash accumulation over time. This can be seen as a drawback by some, but for those seeking pure and consistent life insurance coverage, it’s a defining characteristic.

Clear Focus

The absence of cash accumulation allows for a clear focus on the protection aspect of the policy. Policyholders can be confident that their premiums are exclusively allocated to securing their loved one’s financial future.

Benefit Payout

Death Benefit

The primary benefit of a straight-life policy is the death benefit. This amount will be paid to your beneficiaries when you pass away. It serves as a vital source of financial security for your loved ones.

Assurance for Beneficiaries

The death benefit offers assurance to your beneficiaries, knowing that they will receive financial support when they need it most. This is a critical characteristic that distinguishes straight life insurance from other policies.

Death Benefit

Financial Security

The death benefit provides financial security to your loved ones in need. It can cover various expenses, including funeral costs, outstanding debts, and ongoing living expenses.

Protecting Loved Ones

One of the primary objectives of life insurance is to protect your loved ones. Straight life policies excel in this regard, offering consistent support to your family, even after you’re gone.

No Maturity Benefit

Focusing on Protection

Unlike some other life insurance policies, straight life insurance does not offer a maturity benefit. This policy type is primarily focused on providing protection rather than wealth accumulation.

Policy Purpose

Understanding the policy’s purpose is essential when evaluating which characteristics are consistent with a straight-life policy. It’s designed to protect your loved ones financially, especially in the event of your untimely demise.

Consistency in Premium Payments

Regular Premiums

Straight-life policies require regular premium payments. This consistency ensures that your coverage remains in force throughout your lifetime.

Continuous Commitment

The need for continuous premium payments reflects your commitment to the policy and your desire to provide ongoing financial security to your beneficiaries.

Regular Premiums

Scheduled Payments

Regular premium payments are scheduled, typically on a monthly, quarterly, or annual basis. This predictability is advantageous for those who prefer structured financial commitments.

Long-Term Perspective

The long-term perspective of straight life insurance aligns with regular premium payments. It’s a policy designed for those who plan for their family’s financial future over the years.

Limited Flexibility

Lack of Adjustability

One characteristic consistent with straight-life policies is their limited flexibility. These policies have predefined terms and conditions, and changes may be challenging to implement.

Trade-offs for Stability

While the limited flexibility might be a drawback, it’s also a trade-off for the stability and predictability that straight life insurance offers.

Lack of Adjustability

Premium Rigidity

Premium rigidity results from the lack of adjustability in straight-life policies. The premiums are fixed and unchanging, which some policyholders find reassuring.

Consistency vs. Flexibility

Choosing a straight-life policy is a matter of weighing the consistency and stability it provides against the flexibility of other insurance options.

Premium Rigidity

Stable Premiums

Stable premiums are a distinctive characteristic of straight life insurance. They remain the same throughout the policy’s life, ensuring policyholders can budget effectively.

Predictable Costs

The predictability of premium costs is one of the reasons why straight-life policies are preferred by individuals who want to maintain financial stability.

Risk Pooling

Shared Risk

One of the less-known characteristics of straight life insurance is the concept of risk pooling. Policyholders collectively share the risk of potential claims, contributing to the policy’s long-term stability.

Ensuring Stability

Risk pooling ensures the financial stability of the insurer, making it possible to provide consistent coverage to policyholders.

Shared Risk

Risk Distribution

Risk distribution is an essential aspect of the insurance industry. Straight-life policies effectively distribute the risk among policyholders, preventing the burden from falling solely on individuals.

Collective Stability

The collective stability achieved through risk pooling benefits all policyholders as it maintains the financial strength of the insurer.

Compared with Other Policy Types

Whole Life vs. Term Life

To fully understand which of these characteristics is consistent with a straight life policy, it’s essential to compare it with other policy types. A standard comparison is between whole life and term life insurance.

Straight Life vs. Universal Life

Another relevant comparison is between straight life and universal life insurance. By contrasting these policies, you can gain a better perspective on their unique characteristics.

Suitability

Who Benefits from Straight Life Policies?

Straight-life policies are well-suited for specific individuals and circumstances. Understanding who benefits the most from these policies is essential in making an informed decision.

Assessing Individual Needs

Assessing your individual needs and financial goals is a crucial step in determining if a straight life policy aligns with your long-term objectives.

Assessing Individual Needs

Tailored Protection

Tailored protection is a significant benefit of straight-life policies. These policies can be customized to meet your specific coverage requirements.

Considering Life Stages

Considering your life stages and financial milestones is crucial in determining whether a straight life policy is the right fit for you.

Evaluating Long-Term Goals

Financial Objectives

Your financial objectives are crucial in selecting the right life insurance policy. Straight life insurance is often chosen to align with specific financial goals.

Lifetime Coverage Considerations

Considering the long-term implications of your life insurance choices is vital. Straight-life policies provide lifetime coverage, making them an attractive option for those with extended financial horizons.

Financial Objectives

Aligning with Goals

Choosing a life insurance policy that aligns with your financial goals is paramount. Whether you prioritize wealth accumulation or pure protection, your choice will affect your financial future.

Estate Planning

Estate planning is another aspect to consider when evaluating life insurance options. Straight life insurance can play a significant role in estate planning strategies.

Lifetime Coverage Considerations

Long-Term Assurance

If you seek long-term assurance for your loved ones, straight life insurance can provide that assurance. The consistent coverage it offers ensures that your beneficiaries are protected throughout your lifetime.

Family Security

Family security is a top priority for many. Straight-life policies are designed to provide this security, making them an attractive choice for individuals with dependents.

Tax Implications

Tax-Advantaged Death Benefit

One of the tax-related characteristics consistent with a straight life policy is the potential for a tax-advantaged death benefit. Understanding the tax implications of your policy is crucial for long-term financial planning.

Potential Estate Planning Benefits

Tax advantages can be a valuable component of estate planning, and straight life insurance may offer potential benefits in this regard.

Potential Estate Planning Benefits

Legacy Planning

Legacy planning is often intertwined with estate planning. Straight-life policies can be a valuable tool for preserving and passing on your wealth to future generations.

Minimizing Tax Impact

Minimizing the tax impact on your estate can help you ensure that your loved ones receive the maximum benefit from your financial legacy.

Drawbacks of Straight Life Policies

Cost Considerations

While straight-life policies offer numerous benefits, they also come with certain drawbacks. Cost considerations are a vital factor that may affect your decision to choose this type of insurance.

Lack of Investment Component

The absence of an investment component in straight-life policies can be viewed as a drawback, particularly for those seeking to combine insurance with wealth accumulation.

Cost Considerations

Premium Affordability

Premium affordability is a significant factor that may impact your choice of a life insurance policy. Straight-life policies may have higher premiums compared to some other options.

Budget Implications

Evaluating the budget implications of your life insurance choice is crucial for maintaining your financial stability.

Lack of Investment Component

Policy Focus

Straight life insurance policies maintain a clear focus on providing protection. This focus may need to align with the investment goals of some individuals.

Separate Investment Goals

If you have separate investment goals, consider whether a straight life policy is the most suitable choice for your financial planning.

Alternatives to Consider

Term Life Insurance

To determine which of these characteristics is consistent with a straight life policy, it’s important to explore alternative options. Term life insurance is a common alternative to whole life insurance.

Whole Life Insurance

Whole life insurance, similar to straight life insurance, offers permanent coverage but comes with distinct characteristics. Comparing these alternatives can help you make an informed choice.

Case Studies

Real-Life Scenarios

Examining real-life case studies can provide insight into which of these characteristics is consistent with straight-life policy have been used and the benefits they offer.

Policyholder Experiences

Understanding the experiences of actual policyholders can shed light on the pros and cons of straight life policies in practice.

Real-Life Scenarios

Personal Testimonials

Personal testimonials from policyholders can offer a human touch to understanding the real-world application of Straight Life Policies.

Pros and Cons in Practice

Exploring the pros and cons of Straight Life Policies can help individuals make informed decisions.

Pros and Cons in Practice

Here are the Pros and Cons related to the process of which of these characteristics is consistent with straight life policy:

Rider Options

Evaluating rider options available for Straight Life Policies can allow policyholders to customize their coverage to better suit their needs.

Customizing Your Straight Life Policy

Customization options are consistent with the policy’s adaptability, ensuring it aligns with individual requirements.

Customizing Your Straight Life Policy

Enhancements and Add-Ons

Enhancements and add-ons can enhance the coverage and tailor the policy to specific financial goals.

Choosing the Right Insurance Provider

Selecting the right insurance provider is crucial in customizing a Straight Life Policy to individual needs.

Choosing the Right Insurance Provider

Research and Selection Criteria

Policyholders should conduct research and establish selection criteria to find the insurance provider that best meets their needs.

Financial Strength and Reputation

The financial strength and reputation of an insurance provider are consistent with the policy’s goal of offering reliability and security.

Financial Strength and Reputation

Seeking Expert Advice

Seeking expert advice can give policyholders the guidance they need to make informed decisions.

Consultation with Insurance Professional

Consulting with insurance professionals consistently ensures the policy aligns with individual goals.

Consultation with Insurance Professionals

Making Informed Decisions

Making informed decisions about life insurance is crucial to achieving the desired financial security and peace of mind.

Conclusion

In conclusion, straight-life policies offer consistent characteristics designed to provide lifelong coverage, stable premiums, and a focus on pure insurance without a savings component. The primary goal of these policies is to ensure the financial security of policyholders and their beneficiaries. By understanding these consistent features and assessing individual needs, individuals can make well-informed decisions about whether a Straight Life Policy is the right choice for their financial goals and family’s protection.

FAQs (Frequently Asked Questions)

Here are the Frequently Asked Questions related to the process of which of these characteristics is consistent with straight life policy:

which of these characteristics is consistent with straight life policy?

Consistency in premium payments, fixed premium structure, and lifetime coverage are consistent with a straight-life policy.

What is the significance of life insurance?

Life insurance is vital in providing financial security to individuals and their loved ones, offering a safety net in times of need.

What is a Straight Life Policy?

A Straight Life Policy, also known as a Whole Life Insurance Policy, is a type of life insurance that provides coverage for the entire lifetime of the policyholder, with fixed premiums and a guaranteed death benefit.

Are Straight Life Policies consistent in their characteristics?

Yes, Straight Life Policies consistently provide lifelong coverage, stable premiums, and a focus on pure insurance without a savings component.

What are the drawbacks of Straight Life Policies?

Drawbacks of Straight Life Policies include cost considerations and the lack of an investment component, which may not be suitable for those seeking insurance and investment opportunities.

How can policyholders customize their Straight Life Policies?

Policyholders can customize their Straight Life Policies by exploring rider options and enhancements.