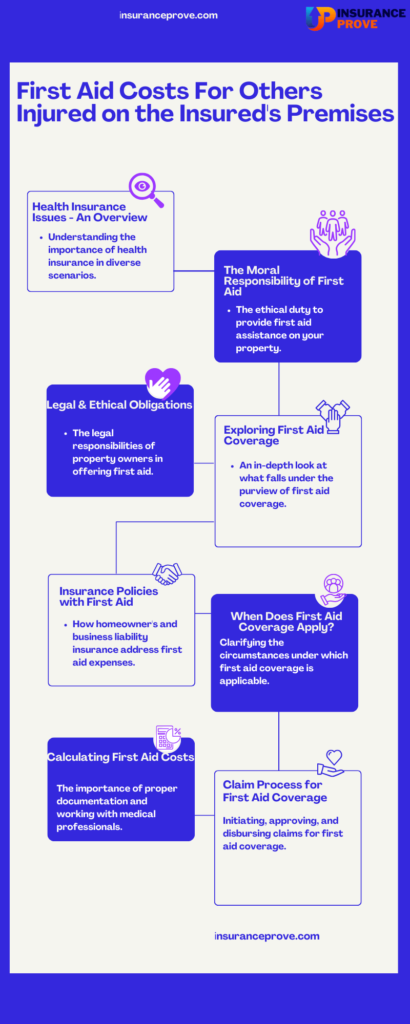

First Aid Costs for Others Injured on the Insured’s Premises” refers to the expenses covered by insurance when providing immediate medical assistance to individuals who sustain injuries while on a property insured by the policyholder. This coverage ensures that necessary first aid and medical supplies are provided, contributing to the well-being and safety of all visitors on the premises.

First Aid Costs

The Importance of First Aid Coverage

First aid coverage is not just a safety net; it’s a moral responsibility. Learn why it’s crucial to understand and assist those injured on your property.

Legal and Moral Obligations

We’ll explore the legal and ethical obligations property owners have when providing first aid to individuals injured on their premises.

What Does First Aid Coverage Include?

Defining First Aid Expenses

First aid expenses encompass a range of costs. We’ll break down what is covered and what isn’t under first aid coverage.

Scope of Coverage

Understanding the scope of first aid coverage ensures you can offer timely and appropriate assistance to injured parties.

Insurance Policies with First Aid Coverage

Homeowner’s Insurance

Delve into homeowner’s insurance and how it often includes provisions for covering first aid expenses incurred on your property.

Business Liability Insurance

Business owners must know how their liability insurance addresses first aid costs for injuries on their premises.

When Does First Aid Coverage Apply?

Accidental Injuries

We’ll clarify when first aid coverage comes into play, particularly in accidental injuries on your property.

Coverage Limitations

You must know any limitations or conditions affecting first aid coverage under your insurance policy.

Costs Covered by First Aid

Medical Supplies

Discover what medical supplies are typically included in first aid coverage, ensuring you’re prepared to provide immediate assistance.

Professional Services

Some injuries may require professional medical attention. Learn how first aid coverage extends to these services.

What First Aid Doesn’t Cover

Chronic Conditions

First aid coverage is designed for acute injuries. We’ll explain why it doesn’t apply to chronic conditions.

Pre-existing Injuries

Find out how pre-existing injuries can impact the coverage of first aid expenses.

Calculating First Aid Costs

Expense Documentation

Proper documentation of expenses is essential for claiming first aid costs. Learn how to keep records for insurance purposes.

Working with Medical Professionals

In some cases, working with medical professionals is necessary. We’ll guide you on how to handle such situations within the insurance framework.

Reporting and Documenting Injuries

Importance of Timely Reporting

We’ll stress the importance of reporting injuries promptly to ensure that first aid coverage is administered without delays.

Record-keeping for Claims

Proper record-keeping is essential. We’ll provide tips on what records to maintain for efficient claims processing.

Claim Process for First Aid Coverage

Initiating the Claim

Learn how to initiate a first aid coverage claim, including the necessary steps and documentation.

Claim Approval and Disbursement

We’ll explain the process from claim submission to approval and the subsequent disbursement of funds.

Legal Implications and Liability

Legal Obligations

Explore the legal obligations and potential liabilities of providing first aid on your property.

Liability of Property Owners

Property owners have a unique set of responsibilities. We’ll outline what you need to know to mitigate liability.

Exclusions and Limitations

Policy Exclusions

Not all scenarios are covered by first aid insurance. Discover standard policy exclusions you should be aware of.

Coverage Restrictions

Understand the restrictions that may apply to first aid coverage, helping you manage expectations.

Secondary Insurance for First Aid Costs

Coordination of Benefits

In cases where multiple insurance policies may apply, we’ll discuss how to coordinate benefits for first aid costs.

Multiple Insurance Policies

Some individuals may have multiple insurance policies. We’ll address how these policies interact in terms of first aid coverage.

Filing a Third-party Claim

Injuries Caused by Third Parties

What happens when third parties on your property cause injuries? Learn how to file a third-party claim.

Pursuing Compensation

We’ll guide you on pursuing compensation when third parties are responsible for injuries.

Insurance Premiums and First Aid Coverage

Impact on Premiums

Understand how first aid costs for others injured on the insured’s premises premiums, allowing you to make informed decisions.

Cost-effectiveness

We’ll assess the cost-effectiveness of having first aid coverage in place and what it means for your overall financial security.

The Role of Insurance Adjusters

Claim Evaluation

Insurance adjusters play a pivotal role in the claim process. Learn how they evaluate first aid claims.

Communication with Insured Parties

Effective communication with insurance adjusters is essential. We’ll provide insights on how to navigate this relationship.

Legal Counsel in First Aid Claims

When to Seek Legal Advice

There are situations where legal advice may be necessary. We’ll help you determine when to seek legal counsel.

Legal Representation

Explore the benefits of having legal representation in first aid claims, ensuring your rights are protected.

Real-life Scenarios

Case Studies

Dive into real-life case studies to understand how first aid coverage can make a difference in various situations.

First Aid Coverage Success Stories

Success stories highlight the importance of first aid coverage. We’ll share inspirational stories of individuals who received timely assistance.

Pros and Cons

Here are the Pros and Cons related to the process of “first aid costs for others injured on the insured’s premises “:

Pros of First Aid Coverage

- Immediate Assistance: First aid coverage ensures that individuals injured on your property receive immediate assistance, potentially preventing severe complications.

- Legal Protection: It offers protection and helps property owners fulfill their moral and legal obligations to injured parties.

- Peace of Mind: Having first aid coverage provides peace of mind, knowing you can offer timely help in case of accidents.

- Assistance for Minor Injuries: It covers expenses related to minor injuries, such as cuts or sprains, reducing the financial burden on the injured party.

Cons of First Aid Coverage

- Not All-inclusive: First aid coverage may not include all types of injuries or may have exclusions, leaving some scenarios uncovered.

- Possible Premium Increase: Adding first aid coverage to your insurance policy may result in a premium increase, affecting your overall insurance costs.

- Limited Scope: First aid coverage focuses on immediate assistance; it may not cover long-term medical care or pre-existing conditions.

Conclusion

Ensuring Financial Protection

In conclusion, we’ll emphasize how understanding first aid costs for others injured on your premises ensures financial protection for you and those in need.

Peace of Mind for Property Owners

Achieving peace of mind is invaluable. We’ll summarize how first aid coverage can provide this peace of mind to property owners.

FAQs (Frequently Asked Questions)

They address common questions about first aid costs for others injured on the insured’s premises, providing clarity and guidance for property owners and insurers.

What exactly is first aid coverage for others injured on my property?

First aid coverage is a provision in some insurance policies that covers the cost of providing immediate assistance to individuals injured on your premises.

Is first aid coverage included in all insurance policies?

No, first aid coverage is not a standard inclusion in all insurance policies. It is typically found in homeowner’s insurance and business liability insurance.

What kind of injuries does first aid coverage apply to?

First aid coverage usually applies to accidental injuries on your property, such as cuts, burns, or minor sprains.

Does first aid insurance cover chronic conditions?

No, first aid insurance is designed for acute injuries and does not cover chronic conditions.

How do I document and calculate first aid costs?

Document and calculate first aid costs, keep records of expenses, including medical supplies and professional services, and provide these records when filing a claim.

Is reporting injuries promptly crucial for first aid coverage?

Yes, reporting injuries promptly is crucial to ensure that first aid coverage can be administered without delays.

What are some standard exclusions from first aid coverage?

Standard exclusions may include self-inflicted injuries, injuries resulting from illegal activities or injuries intentionally caused by the insured.

Do I need to coordinate benefits if I have multiple insurance policies?

If you have multiple insurance policies, it’s essential to coordinate benefits to ensure adequate coverage and protection.

When should I seek legal advice in first aid claims?

Seek legal advice when there are disputes or concerns about liability or when third parties are involved in causing injuries on your property.

Is first aid coverage cost-effective, and how does it affect premiums?

The cost-effectiveness of first aid coverage varies, and adding it to your policy may impact premiums. It’s essential to assess your specific needs and budget.