Life insurance can be costly and complex. It may yield low returns and can have hidden fees.

Exploring the world of life insurance presents a myriad of considerations for those seeking a safety net for their loved ones. The decision to invest in a policy is often accompanied by the pressure to secure financial stability for family members in the event of an unexpected tragedy.

However, the complexities and disadvantages of life insurance policies should be considered. Consumers must navigate potential pitfalls, including hefty premiums, the risk of policy lapses, and the possibility of not receiving the anticipated investment growth. Beyond the financial implications, the emotional burden of discussing mortality complicates this already challenging decision-making process. Crafting a safety plan through life insurance requires careful examination of the drawbacks and a thorough assessment of personal needs versus the long-term implications of such a commitment.

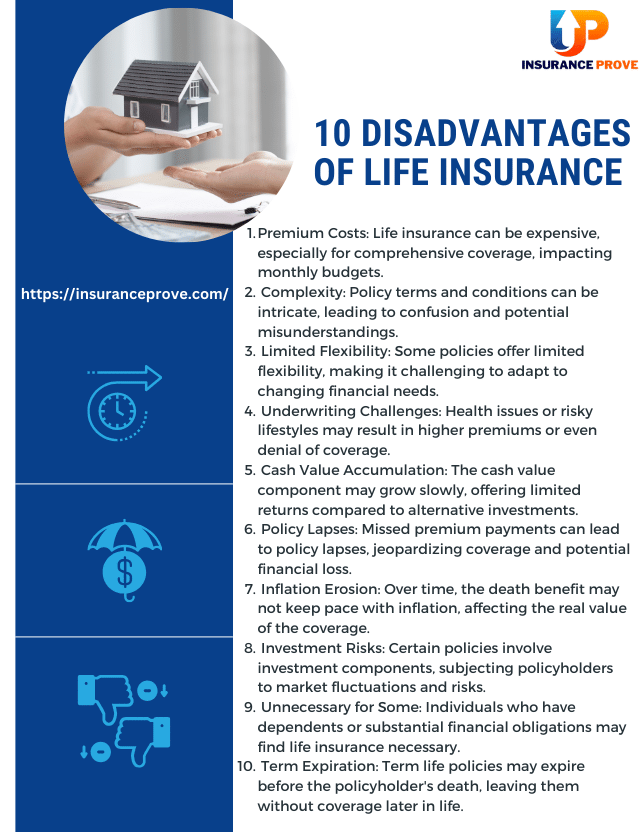

10 disadvantages of life insurance

- Premium Costs: Life insurance can be expensive, especially for comprehensive coverage, impacting monthly budgets.

- Complexity: Policy terms and conditions can be intricate, leading to confusion and potential misunderstandings.

- Limited Flexibility: Some policies offer limited flexibility, making it challenging to adapt to changing financial needs.

- Underwriting Challenges: Health issues or risky lifestyles may result in higher premiums or even denial of coverage.

- Cash Value Accumulation: The cash value component may grow slowly, offering limited returns compared to alternative investments.

- Policy Lapses: Missed premium payments can lead to policy lapses, jeopardizing coverage and potential financial loss.

- Inflation Erosion: Over time, the death benefit may not keep pace with inflation, affecting the real value of the coverage.

- Investment Risks: Certain policies involve investment components, subjecting policyholders to market fluctuations and risks.

- Unnecessary for Some: Individuals who have dependents or substantial financial obligations may find life insurance necessary.

- Term Expiration: Term life policies may expire before the policyholder’s death, leaving them without coverage later in life.

Introduction To Life Insurance

Life insurance is a financial shield, promising security for your loved ones in the unfortunate event of your demise. It’s a contract where individuals pay premiums to an insurance company in exchange for a lump-sum payment, known as a death benefit, to their beneficiaries upon their passing. While it’s often touted as an essential component of a sound financial plan, it’s imperative to understand the apparent advantages and potential downsides.

Understanding Life Insurance Fundamentals

The mechanics of life insurance are straightforward on the surface; you pay premiums over time, and in return, the insurer commits to distributing a set amount of money to your designated beneficiaries after your death. This sum, intended to assist with expenses like funeral costs, outstanding debts, or living costs for dependents, can be a bedrock of financial stability. Nonetheless, the intricacies of life insurance policies can be convoluted, leading some policyholders to need to be more adequately informed about the terms and the spectrum of coverage options available.

- Premiums: Regular payments are made to maintain the policy.

- Death Benefit: The money paid to beneficiaries upon the policyholder’s death.

- Policy Term: The duration for which the insurance coverage is active.

- Cash Value: A component of permanent life insurance policies that accumulates value over time.

Common Myths And Perceived Benefits

Myths surrounding life insurance often cloud the judgment of potential buyers. The perception of life insurance as an ‘investment’ or the belief that it is solely necessary for the family breadwinner is widespread. It is crucial to dispel such myths to ensure that individuals procure policies for the right reasons and with clear expectations.

Myth Reality

Life Insurance as an Investment: Though some policies have investment components, they’re typically not the most cost-efficient investment vehicle.

Only Breadwinners Need It Regardless of who earns, the financial impact of losing a loved one can be significant, warranting coverage.

Young Singles Don’t Need It When debt exists or dependents are in the picture; life insurance can be a prudent decision regardless of marital status.

The Cost Implications Of Life Insurance

While life insurance offers peace of mind and financial security, it doesn’t come without costs. Understanding the financial implications is crucial when evaluating a life insurance policy. Let’s delve into two key areas where your wallet feels the impact: premium payments and the opportunity cost of locking in capital.

Premiums: A Recurring Financial Commitment

Being insured means setting aside a portion of your income regularly to pay premiums. These payments are not a one-off cost but a long-term financial obligation that can stretch over several years or even decades, depending on your policy type.

- Term life insurance: Typically offers lower premiums for a set period.

- Whole life insurance: Comes with higher premiums but lasts for the insured’s lifetime.

Evaluating whether the premium costs align with your financial goals and current situation is essential. Remember, failing to pay these could result in policy lapse.

The Opportunity Cost Of Locked-in Capital

Every dollar paid towards your life insurance is a dollar that isn’t invested elsewhere. The concept of opportunity cost plays a significant role as funds allocated to insurance premiums could have been potentially used for other investments with the possibility of yielding higher returns.

Policy Type Locked-in Capital

Permanent Policies Higher upfront investment with a cash value component that grows over time.

Term Policies Lower premiums with no cash value, purely insurance protection.

Considering these trade-offs is essential, particularly for those who are financially savvy and wish to optimize their portfolio’s performance.

Complexity Of Life Insurance Policies

Understanding the intricacies of life insurance policies is akin to unraveling a complex puzzle. Every approach is embedded with a labyrinth of terms and conditions, shaping how these financial safeguards function. While life insurance offers a financial security blanket, the complexity of these policies often poses considerable challenges for individuals trying to secure the right coverage for their needs.

Navigating Through A Maze Of Terms And Conditions

To secure the benefits of life insurance, policyholders must first navigate through a maze of terms and conditions that can be overwhelming. These terms dictate the detailed workings of the policy, including:

- Premium payments: The frequency, amount, and duration of fees required.

- Benefit triggers Specific criteria must be met for the procedure to pay out.

- Exclusions: Circumstances under which the policy will not pay out.

- Riders: Optional add-ons to enhance coverage, each with its stipulations.

These complicated elements make choosing the right policy challenging and can lead to policy lapse if not managed correctly due to misunderstanding or neglect.

Potential Misunderstandings Due To Complex Clauses

Complex clauses within a life insurance policy can easily lead to misunderstandings. Often crafted in legal jargon, these clauses can include stipulations that must be clarified to the untrained eye. Familiar sources of confusion include:

Clause Type Potential for Misunderstanding

Contestability Period The timeframe within which the insurer can dispute a claim’s validity based on misstatements in the application.

The Incontestability Clause Guarantees claim payments after the contestability period, even with application inaccuracies, creating a false sense of security before that period elapses.

Grace Period The period allowed for late premium payments before the policy lapses, often misunderstood as an extension of coverage.

Flexible Premiums Optional payments above the scheduled premium can alter policy performance unpredictably.

Such intricacies underscore the significance of thoroughly reading the policy document and consulting experienced professionals who can unravel these complexities and assist in making informed decisions.

The Investment Component Pitfalls

The allure of life insurance policies with an investment component, such as whole life or universal life plans, often lies in their promise of financial security and wealth accumulation. Yet, these offerings come with their drawbacks that policyholders must navigate. Though they may appear, these investment-rich insurance plans may only sometimes align with one’s financial objectives or expectations. Let’s dissect some of the pitfalls of investment components and understand why they might not be the economic boon many anticipate.

Questionable Investment Returns Of Whole Life Policies

Whole life insurance policies often tout a blend of insurance protection and savings growth, portraying a dual advantage. However, the investment returns on such policies may only sometimes be competitive with standalone investment options. With returns subject to market conditions and insurance company declarations, the certainty of sizeable investment growth is not guaranteed. The cash value accumulation in these policies is often outpaced by other investment vehicles, such as index funds or stocks, potentially leading to a case of opportunity cost for the uninformed investor.

Hidden Costs Within Investment-linked Plans

Investment-linked insurance plans are well-known for their complexity, a trait that extends to their cost structure. A myriad of hidden costs can significantly erode the investment portion of these policies. Enlisted below are some prices that buyers might be unaware of when they sign on the dotted line:

- Administration Fees: Ongoing fees to manage the policy that may not be evident at first glance.

- Mortality and Expense Risk Charges: Costs attributed to insurance protection that can be hefty and reduce the cash value.

- Fund Management Fees: Charges for the investment management of the funds within the policy that are comparable to mutual fund expenses.

- Surrender Charges: Penalties for withdrawing funds early from the policy can be substantial, particularly within the first several years.

Such a multitude of hidden charges directly impacts the potential growth of the investment component, leaving policyholders with less cash value than anticipated. When the costs eclipse the investment growth, the financial benefits originally foreseen may be severely compromised, leading to second thoughts about the wisdom of choosing an investment-linked insurance plan as a wealth-building strategy.

Potential For Misselling And Fraud

When searching for financial security through life insurance, knowing the potential for misselling and fraud is crucial. This downside of life insurance can lead to monetary loss and emotional distress during already challenging times. Understanding the risk of unethical practices, such as misrepresenting policies by agents and deliberate fraud, can help you make more informed decisions and avoid becoming a victim.

Prevalence Of Misselling By Agents And Brokers

The insurance industry often faces criticism due to the misselling of policies by specific agents and brokers. This situation arises when these intermediaries prioritize their commissions over clients’ needs, leading to policyholders being misled into buying unsuitable products. The prevalence of such practices is not insignificant, and it raises questions on both the trustworthiness of the intermediaries and the robustness of the industry’s regulatory environment.

- Aggressive Sales Tactics: Some agents apply high-pressure sales techniques to close deals quickly.

- Lack of Transparency: Essential details might be obscured or omitted to make policies seem more attractive.

- Overpromising Benefits: Agents might overstate the potential benefits of an approach to secure a sale.

Incidents And Ways To Recognize Insurance Fraud

Fraudulent activities in the insurance sector can range from forged documents to scams that prey on the uninformed. Recognizing red flags is the first step in protecting yourself against such incidents.

Type of Fraud How to Recognize

Identity Theft Unexpected policy statements or unfamiliar transactions on your account may indicate identity theft.

Fake Insurance Companies

Always verify the legitimacy of the insurance provider or health insurance companies through official regulatory bodies and avoid unrealistically low premiums.

Premium Diversion

This is a significant warning sign if your agent requests payments to a personal account or avoids providing receipts.

To further guard against fraud, consider these steps:

- Conduct thorough research on potential insurance policies and providers.

- Insist on detailed policy documentation and keep your records organized.

- Be wary of unsolicited contacts and too-good-to-be-true offers.

Policyholders can better defend against the pitfalls of misselling and fraud within the life insurance sector by staying vigilant and educated.

The Inflexibility Of Life Insurance Policies

Exploring life insurance is a step toward securing your financial future. Yet, a critical look at the inflexibility of life insurance policies unveils notable drawbacks. From personal finance to long-term goals, the rigid structure of many insurance plans could tether policyholders to commitments that clash with changing life circumstances. Unpacking these limitations offers a clearer perspective on this financial instrument’s potential drawbacks.

Limitations Of Policy Loans And Withdrawals

Policies often advertise the ability to take loans or make withdrawals against the cash value of a life insurance policy as a flexible feature. However, this flexibility is not absolute. Here are some essential restrictions to consider:

- Interest Rates: Loans against a policy’s cash value typically come with interest rates that could erode the policy’s value over time if not repaid promptly.

- Repayment Terms: Although you’re borrowing from yourself, failure to adhere to the repayment terms can lead to a reduced death benefit and, in some cases, policy lapse.

- Withdrawal Penalties: Withdrawals may be subject to charges and, if taken in excess, could diminish the death benefit or terminate the policy altogether.

Long-term Commitment With Minimal Room For Change

Life insurance is often a marathon, not a sprint. Entering into a policy is a long-term commitment that might only sometimes align with life’s unpredictable nature. Consider the following concerns:

- Policies may have a surrender period during which canceling the policy incurs substantial fees.

- Should your financial needs or priorities shift, altering the terms of your policy can be complicated or even impossible without incurring additional costs.

- Permanent life insurance often requires a steadfast flow of premium payments that may not be reducible if your financial situation changes.

Understanding these constraints is essential for anyone considering life insurance to ensure alignment with their financial goals and the ability to adapt as those objectives evolve.

Tax Implications And Life Insurance

Life insurance is critical in planning your financial future, but navigating the labyrinth can often bring unforeseen surprises in the form of tax implications. While many tout the benefits of life insurance – such as providing for loved ones and offering peace of mind – it’s equally important to understand how it can affect your taxes. This section delves into the less talked-about disadvantages related to the tax consequences of life insurance policies.

Understanding The Tax Benefits And Penalties

Life insurance policies are known for their tax benefits, yet they come with caveats that policyholders should be attentive to. Here’s a breakdown of potential tax benefits and penalties:

- Death benefits are generally tax-free for beneficiaries, but there are exceptions.

- Cash value growth within some policies is tax-deferred, yet withdrawals above the premium amount could be taxable.

- Loans against the policy’s cash value are not taxable as long as the policy is active but become taxable if the policy lapses.

- Surrender charges and other penalties can also reduce the taxable amount available if the policy is surrendered before a specific term.

Policyholders need to remain vigilant regarding how loans and surrenders can lead to tax penalties and understand the fine print associated with their policy to avoid unexpected tax hits.

Changes In Tax Laws And Their Impact On Policies

Tax laws are never static; they evolve and can profoundly impact life insurance policies. Staying informed about the latest tax law changes is critical for policyholders. A change in laws can:

- Alter the tax status of benefits.

- Adjust the taxable amount of an insurance payout or cash value withdrawal.

- This leads to different tax consequences for loans taken against a policy.

The unpredictability of legislation means insurers and insurers must be proactive in reviewing policies regularly to ensure they remain advantageous after any tax law revisions. For example, the Tax Cuts and Jobs Act of 2017 significantly altered the tax landscape, influencing how policyholders perceived their life insurance tax benefits.

The Reality Of Payouts And Beneficiary Challenges

Life insurance promises the peace of mind that loved ones will be financially secure in the event of one’s passing. Yet, peeling back the curtain and revealing the complexities that can sometimes arise is essential. The reality of life insurance payouts and beneficiary challenges often must be clarified. Policyholders and beneficiaries must be aware of potential pitfalls that can complicate the intended financial assurance. Complex claim processes, payout delays, and beneficiary disputes can transform life insurance from a safety net into a web of complications. This section delves into the realities of denied claims and the intricacies of navigating beneficiary disputes.

Cases Of Denied Claims And Payout Delays

When beneficiaries file a claim for the life insurance payout, they anticipate a smooth process. Unfortunately, there are instances where claims get rejected or significantly delayed. Here are some common reasons for denied claims:

- Non-disclosure or misrepresentation: When the insured conceals or misstates essential information.

- Lapsed policies due to non-payment: Failure to maintain premium payments can result in a lapsed policy, voiding coverage.

- Policy exclusions: Each policy has specific exclusions, which may include death caused by certain activities or in particular regions.

- Contestability period: Death within the two-year window after policy initiation can trigger an insurer’s investigation.

Payout delays are another pain point. During an already difficult time, beneficiaries might face weeks or even months of waiting due to lengthy investigations or administrative red tape. Reasons for delay can stem from complex cause-of-death inquiries to interactions with legal proceedings. Companies sometimes require thorough documentation, adding to the time before a payout is received.

Navigating Through Beneficiary Disputes

Beneficiary disputes add another layer of challenges in the realm of life insurance. When multiple parties claim entitlement to the proceeds or the policy’s wording is ambiguous, it sets the stage for potential conflict. Disputes often occur due to:

- Errors in how beneficiaries are listed (e.g., unclear designations or outdated information).

- Questions about the policyholder’s intent (possibly due to changes made close to their time of death).

- Conflicts arising from increased family complexity, including divorces and remarriages.

These disputes can lead to litigation and protracted court battles, further delaying payouts and adding legal costs. Beneficiaries might need to navigate the legal system to establish their claim, which requires time, patience, and often a legal counsel’s assistance. This process stresses financial resources and emotional well-being, turning a safety net into a contentious battleground.

Life Insurance As A Financial Tool: Pro’s Limitations

Life Insurance as a Financial Tool: Pro’s Limitations – While life insurance is a crucial safety net for many, safeguarding loved ones in case of an unexpected tragedy, its role as a financial asset has certain restrictions. Often, people look at life insurance with a singular lens, considering it a comprehensive solution to their investment needs. Unfortunately, this perception doesn’t feel the inherent limitations against other financial tools. Let’s delve into some key aspects where life insurance might not entirely measure up as an investment strategy.

Overestimating Insurance As An Asset

Life insurance is often mistaken for a strong asset class, leading to overestimating its value in one’s overall financial portfolio. While it does provide peace of mind and economic security for beneficiaries, its investment component only sometimes offers the best return on investment (ROI), especially when the premiums for permanent life insurance policies are high. Many policies have cash value components that grow tax-deferred; however, when compared to the premiums paid over time, the actual yield might pale compared to other investment avenues.

Compared with Alternative Financial Instruments

Contrasting life insurance with alternative financial instruments is essential to grasp the complete picture of its investment potential. Stocks, bonds, mutual funds, and even real estate often deliver incredible long-term growth for one’s portfolio. For example:

Financial Instrument Characteristics Potential Returns

Life Insurance Tax-deferred growth, death benefit, and fixed premiums are Lower relative to other investments

Stocks High liquidity, high potential returns, dividend income Variable, potentially higher depending on market conditions

Real Estate Tangible asset, potential rental income, capital appreciation Depends on location and market dynamics, possibly high

When reviewing your financial goals, it’s essential to recognize that life insurance may offer growth opportunities or liquidity different from these alternatives. The cash value of a life insurance policy grows at a more conservative rate, and accessing funds can be less straightforward, often requiring policy loans or surrender that can impact the death benefit.

Psychological And Emotional Considerations

While life insurance serves as a financial safety net, it’s not devoid of psychological and emotional implications. Deeply entwined with our well-being, the nuances of managing a life insurance policy can surface stress and discomfort. Delving into this aspect, we uncover how life insurance can unwittingly influence our mental state.

The Stress Of Ongoing Payment Commitments

Life insurance requires a long-term financial commitment. Policyholders must make regular premium payments to keep their coverage active. This obligation can induce stress, especially when finances are tight. The pressure to maintain payments can lead to anxiety:

- Budgeting worries: Allocating funds for premiums may strain the monthly budget.

- Long-term planning: Committing to years, or even decades, of payments requires foresight and stability.

- Changing financial circumstances: A sudden job loss or unexpected expenses can make it challenging to meet ends, let alone keep up with insurance payments.

For many, the fear of policy lapse due to non-payment adds another layer of anxiety, turning what is meant to be a protective measure into a source of persistent concern.

Dealing With The Morbidity Of Life Insurance

Life insurance is inherently tied to thoughts of mortality. Engaging with this type of insurance means having to confront and consider one’s death. This reality can be unsettling:

- Mental discomfort: Regular reminders of life’s impermanence can be distressing.

- Family concerns: Discussing policy details with loved ones often involves difficult conversations about death and financial aftermath.

- Existential reflection: Planning for the financial aspects of one’s demise may trigger existential questions and fears.

Choosing life insurance is a responsible step, but it’s not without its emotional toll. Individuals might find that the process intensifies concerns about their health, safety, and the well-being of their loved ones after they’re gone.

Insurance And Health Dynamics

Understanding the nuances of insurance and health dynamics is critical for anyone considering life insurance. Health status is pivotal in insurance, influencing everything from eligibility to premium costs. Recognizing how pre-existing conditions and subsequent health changes impact life insurance is essential for making informed decisions.

The Impact Of Pre-existing Conditions On Coverage

Life insurance applicants with pre-existing medical conditions may face challenges securing coverage. Insurance providers assess the risk of insuring individuals based on their health history, which can lead to:

- Higher premiums: Insurers often charge more to cover those deemed higher risk.

- Exclusion riders: Specific conditions may be excluded from coverage.

- Limited options: Some insurers may not offer policies to individuals with significant health issues.

- Complete denial of coverage: In severe cases, an applicant may be denied coverage.

Finding a policy accommodating your health history requires diligent research and consulting insurance experts.

Health Changes And Their Effects On Policy Renewal

Life insurance is not a static agreement; health changes can significantly affect policy renewal and terms. As policyholders age or if their health deteriorates, they may encounter:

- Non-renewal risks: Some term policies may not be renewable if the policyholder develops serious health issues.

- Jump in premiums: Should the policy be renewable, it may come with substantially higher premiums.

- Conversion difficulties: Converting a term policy to a whole life policy might be hindered by poor health, limiting flexibility.

Maintaining a policy requires ongoing assessment and possible adaptation to one’s changing health landscape.

The Liquidity Concerns With Life Insurance

When exploring the world of life insurance, many individuals prize the peace of mind that comes from knowing their loved ones will have financial support in the event of their passing. Yet, amidst this security, a critical factor often comes into sharp focus: liquidity. Liquidity, or an asset’s ease of conversion to cash without significant loss in value, is a pressing concern. With life insurance, extracting value from your policy is only sometimes straightforward, can involve complex procedures, and might incur unexpected costs.

Access To Cash Value And Surrender Fees

Access to the cash value in particular life insurance policies, like whole life insurance, presents a tempting liquidity feature. Policyholders may view this as a form of forced savings account, anticipating access to cash when needed. The reality, however, is that tapping into this cash value is more liquid than one might hope. Here are some critical points to consider:

- Withdrawals or loans against the policy’s cash value can reduce the death benefit, potentially leaving beneficiaries with less financial support.

- Surrender fees can dramatically cut into the cash value, especially in the policy’s early years. These fees are charged by insurance providers when a policy is terminated early and cashed out.

- Cash value accumulation takes time, often several years, before a significant amount is available for policyholders to access.

Assessing The Liquidity Of Life Insurance Compared To Alternatives

Putting life insurance in the hot seat and comparing its liquidity to alternative vehicles is crucial for informed financial planning. Here’s how life insurance stacks up:

Financial Vehicle Liquidity Level Access Timeframe Associated Costs

Life Insurance Low to Moderate Varies Surrender charges, potential interest on policy loans

Savings Account High Immediate Minimal to none

Investment Portfolio Varies Several days to weeks Brokerage fees, capital gains tax

The above lines highlight that while life insurance can provide some form of liquidity through a cash value component, it is dwarfed by the flexibility and ease of access offered by traditional savings accounts and many investment vehicles—albeit often at a trade-off of lower returns or potential market risks.

The Question Of Adequacy And Coverage Gaps

The Question of Adequacy and Coverage Gaps in life insurance is a critical aspect that policyholders face when securing their financial future. It is essential to understand that life insurance is not a one-size-fits-all solution; it requires tailored strategies to ensure that coverage meets individual needs. Misjudging the amount of insurance can lead to either underinsurance, where beneficiaries receive insufficient funds, or over-insurance, resulting in unnecessary premiums. Identifying and managing these gaps is pivotal to securing robust financial protection.

Determining The Sufficient Level Of Insurance Coverage

Finding the right balance in life insurance coverage is a task that hinges on various factors, including income, debts, living expenses, and future financial obligations. To determine this level:

- Calculate current and future financial responsibilities.

- Factor in potential income growth and inflation.

- Assess existing assets and savings that may diminish the need for coverage.

It’s important to periodically review and adjust the policy to keep pace with life changes such as marriage, having children, or purchasing a home.

Dealing With Underinsurance And Insurance Issues

Both underinsurance and overinsurance pose problems for policyholders. To address these:

Issue Challenges Strategies: Underinsurance: Insufficient funds for beneficiaries, debts left unpaid, financial hardship. Regularly review policy and adjust coverage to match life stages.

Overinsurance: Unnecessarily high premiums and financial strain due to expenditure on insurance. Careful assessment of actual needs, avoiding the inclusion of extra riders.

Policyholders must be vigilant: to avoid these pitfalls and ensure their life insurance investments are sound and genuinely beneficial for those they intend to protect.

Consumer Protection And Legal Aspects

Welcome to a critical discussion on life insurance’s ‘Consumer Protection and Legal Aspects.’ While insurance can provide crucial financial security, it’s imperative to understand the limitations and protections afforded to consumers. The legal landscape surrounding life insurance is both a safety net and a web of complexity. Navigating this can be daunting, but understanding your rights and the potential drawbacks is essential for making informed decisions.

Regulatory Limitations And Consumer Rights

The life insurance regulatory framework establishes guidelines for insurers and provisions for policyholders. However, regulatory limitations sometimes fail to cater to the consumer’s best interest. Understanding these rights is the first step toward empowered decision-making.

- Restricted Coverage: Regulations may impose limits on the amount and scope of coverage, leading to potential gaps in protection.

- Varying State Laws: Insurance is regulated at the state level, causing inconsistencies in the security and services available across different jurisdictions.

- Consumer Rights Awareness: Policyholders often need a more thorough knowledge of their rights, hindering their ability to make the most of their policies.

Legal Recourse For Disputes And Policyholder Protections

Legal recourse is available when conflicts arise, yet it can be more complex. Understanding the policyholder protections in place can guide you through resolving disputes.

- Complex Claim Procedures: Navigating the claim process can be confusing and time-consuming, discouraging policyholders from pursuing their claims.

- Dispute Resolution: Legal avenues such as arbitration or litigation can be costly and lengthy, making it challenging for individuals to seek justice.

- Consumer Advocacy Groups: These groups offer support and can guide policyholders through the legal complexities, but they may have limited power against large insurance companies.

Misconceptions About Life Insurance As An Inheritance Tool

Life insurance policies are often marketed as financial safeguards for your loved ones in the event of your untimely death. However, many individuals mistakenly view life insurance solely as a tool for creating an inheritance. While it can contribute to an estate, some nuances and limitations affect its efficacy in estate planning. A deeper understanding of life insurance helps assess whether it meets your long-term inheritance goals.

Assessing The Effectiveness Of Life Insurance In Estate Planning

When considering life insurance for estate planning, it’s crucial to evaluate its effectiveness comprehensively:

- Cost versus Benefit: High premiums over time may outweigh the benefits, especially with permanent life insurance policies.

- Tax Implications: The death benefit could be subject to estate taxes if the policyholder’s estate exceeds federal or state tax thresholds.

- Liquidity Issues: Life insurance proceeds are generally liquid at death, but payout delays may not align with immediate needs.

Understanding claim procedures and policy details such as exclusions or contestability periods can also dictate the policy’s role in your estate plan.

Alternatives For Bequeathing Wealth To Heirs

Several alternatives exist for transferring wealth to heirs that may offer more flexibility or efficiency than life insurance:

- Trusts: Provides controlled distribution of assets and potential tax benefits.

- Retirement Accounts: Beneficiaries can inherit assets like IRAs or 401(k)s, often enjoying tax advantages.

- Real Estate: Directly bequeathing property can save on probate and reduce complexity.

- Stocks and Bonds: Passing on investments can allow for potential appreciation benefits and step-up in basis for tax purposes.

Considering these alternatives should involve consultation with a financial planner or estate attorney to align with your estate’s specific goals and circumstances.

Corporate-owned Life Insurance Complexities

Regarding life insurance, personal policies are just one side of the equation. Corporate-Owned Life Insurance (COLI), or company-owned life insurance, represents a complex facet with unique implications. Businesses often procure life insurance on key executives or employees, but this practice has intricacies that can significantly affect the company and the individuals insured. Plunge into the depths of COLI and its inherent challenges to determine if the protection offered aligns with the potential pitfalls.

Understanding The Role Of Life Insurance In Business

Life insurance within a business context serves multiple purposes. It is a strategy employed to safeguard a company against financial losses that may arise due to the unexpected passing of a critical employee whose contribution is vital to its operations. This insurance type can also play a role in succession planning, ensuring a smooth transition by providing necessary funds. Companies might use COLI for:

- Liquidity during the transition period following an individual’s death.

- Funding buy-sell agreements among business partners.

- Acting as a financial cushion against the loss of integral personnel.

Risks Associated With Employer-provided Life Insurance

While employer-provided life insurance can be an asset, it carries distinct risks that must be weighed carefully:

Risk Factor Details:

Consent and Awareness Employees must be informed and consent to coverage, which sometimes needs to be communicated more effectively.

Tax Implications Proceeds may be taxable under certain conditions, contrasting personal life insurance policies.

Benefit Allocation The death benefit primarily aids the company, which may not align with the individual’s financial goals.

Policy Ownership Should the insured leave the company, they may lose the coverage if it’s not transferable or convertible.

The mechanics of employer-provided life insurance can be intricate, with contracts that are often challenging to navigate. Companies must handle these policies with due diligence, balancing risk management against potential complications.

The Dependence On Agent Expertise And Ethics

Choosing the right life insurance policy is a crucial decision that often hinges on the knowledge and integrity of the agent involved in the transaction. A knowledgeable and ethical agent can guide you through the complex web of policy options to find the best coverage for your unique needs. However, not all agents possess the same level of expertise or commit to the highest standards of professional conduct. This reliance on an agent’s proficiency and moral compass introduces several potential disadvantages when navigating the world of life insurance.

The Significance Of Trustworthy And Knowledgeable Agents

A trustworthy and well-informed agent is the cornerstone of a beneficial life insurance experience. They are responsible for:

- Educating clients about different types of life insurance policies,

- Assessing the client’s financial situation and insurance needs,

- Recommending suitable coverage options,

- Clarifying terms and conditions and

- Helping navigate through the application and underwriting processes.

A lack of agent expertise can lead to suboptimal policy choices, potentially resulting in inadequate coverage or unnecessarily high premiums.

Ethical Dilemmas In The Life Insurance Industry

Life insurance agents face various ethical challenges that can impact their advice and products. These challenges include:

Conflict of Interest Transparency Issues Pressure to Meet Sales Targets

Agents might favor policies that provide higher commissions over those that best meet the client’s needs. Some agents need to be more fully transparent about fees, commissions, or the policy’s long-term financial implications. Agents might be influenced by the need to meet quotas, pushing them to sell unnecessary or overpriced procedures.

An agent’s failure to uphold ethical standards can have severe financial and emotional repercussions for families, as it might lead to purchasing life insurance that does not align with the client’s interests.

Coverage Adequacy Over Time

Understanding the Coverage Adequacy Over Time is crucial when evaluating a life insurance policy. A plan that seems perfect now might carry different value years down the line. Financial responsibilities evolve, and the economy’s fluctuating nature can impact the future benefit value. It’s essential to recognize that more than today’s coverage might be needed for tomorrow’s needs.

Addressing Changes In Financial Responsibilities

Life insurance is designed to provide peace of mind, ensuring that loved ones are taken care of financially in the event of an unexpected passing. However, life stages drastically alter fiscal duties, potentially rendering a once-equal policy insufficient. These changes can include:

- Family growth: The addition of children or dependents increases financial responsibility.

- Mortgage commitments: Upgrading or purchasing a new home can significantly raise the need for coverage.

- Business obligations: Starting or expanding a business might necessitate a higher policy value to cover any associated debts.

- Education expenses: Future educational costs for dependents should also be considered in coverage.

Regularly revising the life insurance coverage to accommodate these changes is essential for maintaining its relevance and adequacy over time.

Inflation And Its Impact On Future Benefit Value

Inflation’s stealthy erosion of value is often overlooked when choosing life insurance. Today’s dollar will invariably buy less in the future. Understanding inflation’s impact on the eventual payout of a life insurance policy is non-negotiable.

Year Estimated Inflation Rate (%) Projected Value of Coverage

Current 2.5 $100,000

Year 10 2.5 $78,355

Year 20 2.5 $61,401

Year 30 2.5 $48,102

This cost illustrates the diminishing value of a $100,000 policy across three decades at a constant inflation rate. Policyholders must account for inflation and consider riders or policies with built-in inflation protection to preserve the benefit’s purchasing power over the long term.

Product Diversity And Decision-making Challenges

Exploring life insurance brings a staggering array of products, each with unique features and benefits. This double-edged sword of product diversity presents individuals with endless choices and poses significant decision-making challenges.

Choosing The Right Policy Amongst Numerous Options

Navigating the Life Insurance Maze: As consumers, we face many life insurance policies. Whether you’re considering term life, whole life, or universal life insurance, each category branches into many sub-types. The challenge lies in pinpointing the policy that aligns perfectly with your personal and financial goals.

- Term vs. Permanent: Would a fixed-duration term life policy suffice, or is a permanent life insurance more apt for lifelong coverage?

- Investment Component: Should your policy double as an investment, like universal life insurance?

- Riders and Benefits: Additional policy features can complicate choice; critical illness riders, waiver of premium options, and conversion features all demand careful consideration.

The Paralysis Of Analysis In Selecting Insurance Products

Too Many Choices, Too Little Clarity: When faced with multiple insurance products, a common pitfall is becoming trapped in analysis paralysis. This occurs when the fear of making the wrong choice leads to excessive overthinking, ultimately resulting in no decision.

- Research Dilemma: The sheer volume of information can be daunting, leaving many to postpone the decision.

- Risk Aversion: The potential consequences of selecting an ill-suited policy amplify the fear of commitment.

- Seeking Perfection: Striving for the ‘ideal’ policy can turn an already complex decision into an unending quest.

Comparisons of premiums, coverage, benefits, exclusions, and financial stability of insurers demand attention and meticulous comparison. The task can become a significant stumbling block in securing financial protection without guidance.

Navigating Life Insurance Disadvantages

Confronting the challenges of life insurance head-on is crucial when seeking the security these policies are designed to provide. While life insurance offers undeniable benefits, the disadvantages can’t be ignored. In this conclusive part of our discussion, we’ll navigate these drawbacks, equipping you with the knowledge to sidestep potential pitfalls and harness the optimum policy for your circumstances.

Summing Up The Caveats Of Life Insurance

The journey through the intricate landscape of life insurance is filled with a mixture of benefits and deterrents. To summarize the less favorable aspects:

- Costs can be prohibitive, particularly for premium policies or if health issues are present.

- The fine print in contracts sometimes conceals exceptions or clauses that limit payouts.

- Policyholders with a change in financial circumstances may find premiums unsustainable.

- Complex products often require professional advice to navigate, adding to overall expenses.

- There can be limited investment growth potential in some life insurance policies.

- Taxes and fees can erode the policy’s value or beneficiaries’ inheritances.

- Individuals may only need a policy with dependents or sufficient assets.

- The potential for opportunity cost, with funds locked into premiums rather than other investments.

- Inflexibility in some guidelines can make adjustments to changing life situations difficult.

- Claim disputes can delay payouts, causing financial stress for beneficiaries.

Making Informed Decisions For Your Insurance Needs

Making the right choice in life insurance hinges on a thorough understanding and scrutiny. Being well-informed empowers you to make decisions that align with your financial goals and personal requirements. Consider the following strategies:

- Research various policies to find one that fits your specific needs and budget.

- Seek the expertise of a reputable financial advisor to clarify doubts and provide guidance.

- Calculate the coverage required to ensure peace of mind without overpaying for unnecessary benefits.

- Review the policy periodically, adapting as your circumstances evolve.

Balancing the pros and cons, life insurance can still significantly contribute to your family’s financial stability. Stay aware of the constraints and confidently enter the domain of insurance, prepared to select the arrangement that best serves you and your loved ones.

Conclusion

Navigating the complexities of life insurance demands thorough consideration. While it offers critical financial protection, the drawbacks highlighted cannot be ignored. Weighing these factors is essential before committing to a policy. Thoughtful planning ensures life insurance complements your financial strategy, not complicates it. Choose wisely for peace of mind.

Frequently Asked Questions For 10 Disadvantages Of Life Insurance

The main disadvantage of life insurance is its cost, which can be high, particularly for whole-life policies or individuals with health issues.

Insurance can be costly, with premiums accumulating over time. Coverage limitations may exclude certain risks or damages. Claim procedures can be complex and time-consuming. Policyholders might only utilize their coverage if they feel a loss of investment. Insurers can deny claims based on technicalities or errors.

Many people avoid life insurance due to the perceived complexity, cost concerns, and discomfort with discussing mortality. Some prioritize immediate financial needs over future planning, while others may need help understanding insurance benefits.

Insurance can incur high premiums, complex policies, claim denials, coverage limitations, and the potential for increased dependency.

Life insurance is a contract between an individual and an insurer, where the insurer promises to pay a designated beneficiary a sum of money upon the insured person’s death.

Life insurance premiums can vary widely based on age, health, policy type, and coverage amount, with some policies being quite expensive over time.

Some life insurance policies may have hidden fees, such as administrative charges or insurance costs that are only sometimes clearly outlined upfront.

Certain types of life insurance, like term policies, can have inflexible coverage rules and may not offer investment options or cash value accumulation.

Life insurance payouts are typically tax-free, but some aspects, like estate taxes or policy loans, can create tax obligations for beneficiaries.

While life insurance is designed to provide financial security, policy clauses or inadequate coverage can sometimes fail to meet a family’s needs.